Citicorp: The Evolution of a Financial Titan

Citicorp’s Foundation: The Early Days

Founded in 1812 as the City Bank of New York, Citicorp began its illustrious journey in a modest setting. Initially, it was a banking firm with a solid local presence. Leaders like Moses Taylor, who took the reins in the mid-19th century, were instrumental in laying down the pillars of what would become one of the largest financial institutions worldwide. From financing the rapid expansion of the United States to surviving the Civil War, Citicorp’s early days were marked by resilience and forward-thinking — crucial elements in its DNA.

| **Topic** | **Details** |

|---|---|

| Name | Citicorp |

| Formation | 1967 |

| Merger | Formed from the merger of Citicorp and Travelers Group, Inc. in 1998 |

| Headquarters | New York City, USA |

| Parent Company | Citigroup Inc. |

| Industry | Financial Services |

| Revenue | $78.82 billion annually |

| Services | Investment banking, financial services, credit services, advisory services |

| Historical Event | In 1998, Citicorp and Travelers Group merged to form Citigroup |

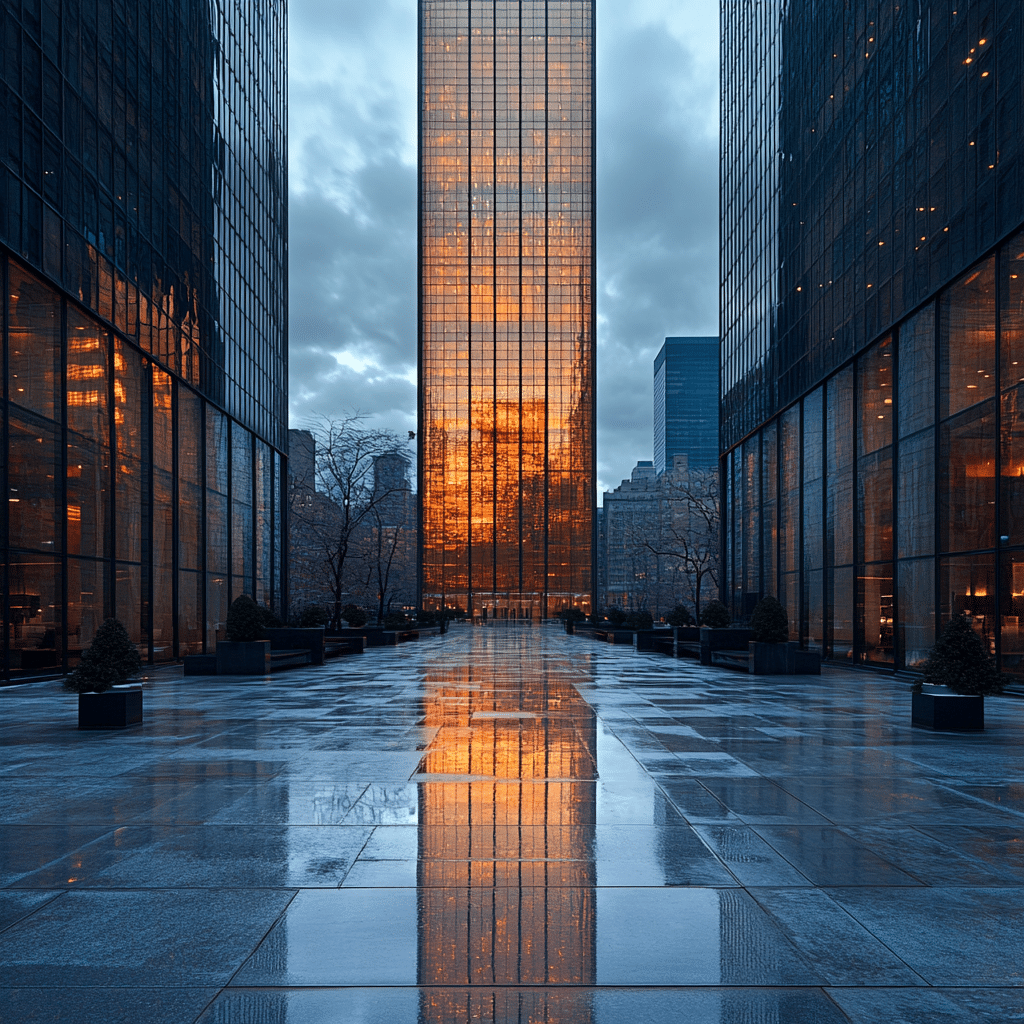

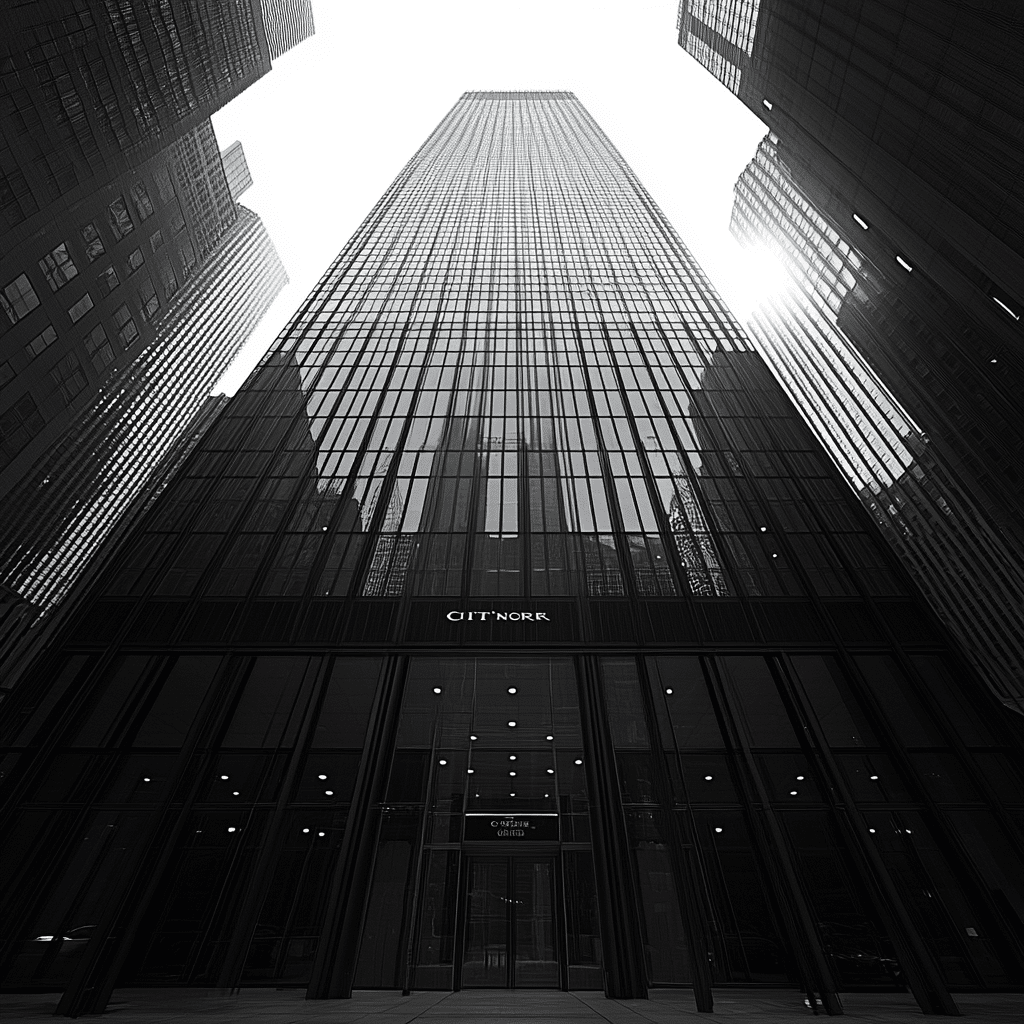

| Building | Citicorp Center, now 601 Lexington Avenue, acquired by Boston Properties in 2001 |

| Design Flaw | Less than a year after the Citicorp Center’s completion, structural strengthening was necessary due to vulnerability to high winds. |

| Spinoff | Travelers Group was spun off from Citigroup in 2002 |

| Current Usage | The former Citicorp Center, now known as 601 Lexington Avenue, serves as an office building |

Citicorp’s Global Expansion: Pioneering International Banking

By the mid-20th century, Citicorp started casting its net far and wide beyond American waters. The acquisition of Banamex in Mexico in 2001 was a significant milestone, marking a robust international presence. The expansion was not just in numbers; it was strategic, focusing on regions with immense growth potential. Citicorp’s entry into European markets was another feather in its cap, making it a global financial powerhouse capable of competing with giants like JP Morgan Chase. This rapid globalization gave Citicorp leverage over its competitors, emphasizing its pioneering spirit.

Citicorp and Financial Innovation: A Legacy of Firsts

Citicorp has always been a trailblazer in financial innovation, setting industry standards with many firsts:

1. Introduction of Credit Cards: In the 1960s, Citicorp revolutionized consumer finance by launching the first national credit card, the Citibank card, which eventually became MasterCard. This paved the way for modern credit systems.

2. Automated Teller Machines (ATMs): The installation of the world’s first ATMs in the 1970s, offering unparalleled convenience to customers, was another groundbreaking move.

3. Online Banking Platforms: By the 1990s, Citicorp led the charge into the digital frontier, adopting online banking services that became the blueprint for today’s digital banking platforms.

Economic Upheaval and Resilience: Surviving Financial Crises

Throughout its history, Citicorp has demonstrated resilience, weathering numerous financial storms. The Latin American debt crisis of the 1980s tested its mettle, forcing strategic decisions that shaped its future. Leaders like John S. Reed, known for his meticulous risk planning, and Vikram Pandit, who guided Citicorp through the 2008 financial crisis, played vital roles during tough times. These crises underscored the importance of adaptability and robust management, reflecting Citicorp’s ability to bounce back stronger.

Citicorp’s Role in Corporate Responsibility and Governance

Citicorp also actively engages in corporate social responsibility (CSR) and governance reforms:

1. Sustainability Initiatives: Investments in green finance and contributions to fighting climate change reflect Citicorp’s commitment to a sustainable future.

2. Philanthropy and Community Investment: Programs like the Citi Foundation’s Pathways to Progress initiative, aimed at financial inclusion and enhancing economic opportunities in underserved communities, showcase its philanthropic spirit.

3. Governance Reforms: Transformative changes in management practices have bolstered transparency and accountability, reflecting Citicorp’s commitment to ethical governance.

Comparisons with Rivals: Citicorp vs. JP Morgan Chase and Bank of America

Comparing Citicorp with its main rivals reveals intriguing insights:

1. JP Morgan Chase: Citicorp’s risk management strategies sharply contrast with JP Morgan’s conservative approach, shedding light on different corporate cultures.

2. Bank of America: While Bank of America excels in customer service, Citicorp’s global presence and diverse financial products are hard to beat, showcasing each company’s unique strengths.

Citicorp’s Modern Image: Adapting to the 21st Century

In recent years, Citicorp has made significant strides to stay ahead in a rapidly changing financial landscape:

1. Digital Transformation: Citicorp has heavily invested in fintech and AI, partnering with startups and tech giants to modernize its offerings.

2. Mobile Banking: It has significantly enhanced its mobile banking experience, focusing on user-friendly interfaces and robust security features.

3. Fintech Collaborations: Strategic alliances with fintech companies have enabled Citicorp to leverage new technologies, enhancing customer service and expanding its technological expertise.

Reflections on Citicorp’s Astonishing Financial Legacy

From its humble beginnings as the City Bank of New York to becoming a global financial titan, Citicorp’s journey is a testament to innovation, resilience, and strategic foresight. With an annual revenue of $78.82 billion, Citicorp’s impact on the global economy is undeniable. As the financial industry evolves, Citicorp continues to set benchmarks, embodying the principles of adaptability and excellence. Its story serves as a model for financial institutions worldwide, proving that success is built on vision, perseverance, and the ability to adapt to changing tides.

By dissecting these facets, we uncover Citicorp’s profound legacy — a complex, multifaceted institution that has not only shaped the banking industry but also continues to influence the global financial landscape.

Citicorp’s Astonishing Financial Legacy

An Unexpected Starting Point

Citicorp, a name synonymous with American banking, began its journey in an era when financial institutions were few and far between. Established in 1812 as the City Bank of New York, Citicorp has grown exponentially, impacting various sectors and touching lives across the globe. It’s fascinating to see just how far a modest banking business has come, much like how a lone figure contrasts against the grandeur of a Shaq height And weight comparison.

Pioneering Moments and Fun Milestones

Ever wonder what links a bank to an astronomical event? Citicorp’s headquarters at 399 Park Avenue, New York, boasts panoramic views which, in certain seasons, offer a view akin to the mesmerizing phenomena of Chicagohenge sunset. This highlights how Citicorp has not only championed financial markets but has also become a silent witness to captivating natural phenomena.

Another quirky tidbit is that Citicorp’s ATM network is almost as widespread as the famous sightings of fake taxi in The Uk. With such a vast presence, it’s intriguing to imagine each ATM silently servicing countless transactions daily, always ready and reliable.

The Ripple Effects of Financial Leadership

Citicorp’s innovation didn’t just stop at ATMs; they’ve also influenced car loan sectors, thus aiding millions of Americans in purchasing their vehicles. Their initiatives often get compared to innovative rates, like those seen in Usaa new car loan rates, demonstrating the bank’s continued relevance in various financial spheres.

Moreover, Citicorp’s involvement isn’t limited to staid financial dealings. Their community outreach is as significant and inspiring as the family support seen with Adley Rutschman ’ s sister, symbolizing their commitment to nurturing a stronger, more inclusive society.

Celebrating Milestones Across Time

Citicorp’s illustrious journey is also dotted with remarkable dates, such as their founding year. There’s a fun parallel with famous events like the annual Chicago River dyeing 2024, which shows how Citicorp’s legacy stands tall through the ages. From being a cornerstone of American banking to helping individuals during their darkest times, their impact is profound and ongoing.

In essence, the story of Citicorp is a tale of growth intertwined with history, innovation, and unanticipated connections, demonstrating just how deeply financial institutions can embed themselves into the fabric of society.

Are Citicorp and Citigroup the same?

Citicorp and Citigroup aren’t exactly the same. Citigroup is the parent company formed in 1998 from a merger between Citicorp and Travelers Group. So, Citicorp is now part of Citigroup.

What was the Citicorp problem?

When the Citicorp Center was completed, it had a design flaw that made it susceptible to collapse in high winds. The building was quickly reinforced to prevent this.

Are Citi and Citibank the same?

Citi and Citibank are related but not the same. Citibank is a major division under the larger umbrella of Citigroup.

Who is the owner of Citicorp?

Nobody really “owns” Citicorp in the traditional sense since it’s a part of Citigroup. Citigroup is a public company with its ownership spread among its shareholders.

Who is the parent company of Citibank?

Citibank is a subsidiary of Citigroup. So, Citigroup is the parent company of Citibank.

Who owns most of Citigroup?

Citigroup is publicly owned, meaning its shares are held by various individual and institutional investors.

Why did Citigroup fail?

Citigroup faced massive losses during the 2008 financial crisis due to exposure to subprime mortgages, leading to a government bailout. It didn’t actually fail but it came pretty close.

What are the ethical issues with Citicorp?

Ethical issues with Citicorp have included accusations of improper trading practices and money laundering activities, which have brought them under regulatory scrutiny several times.

Why are people protesting Citibank?

People have protested Citibank for various reasons, including its lending practices and its role in the 2008 financial crisis, as well as more recent environmental concerns.

What is the oldest bank in America?

The oldest bank in America is the Bank of New York, which was founded in 1784.

Are Citi and Chase the same bank?

Citi and Chase are not the same bank. Chase is a brand of JPMorgan Chase & Co., while Citi is the short name for Citigroup Inc.

What is Citi financial called now?

CitiFinancial is now called OneMain Financial.

What is the difference between Citibank and Citicorp?

Citibank is a part of Citicorp, the latter being a division within Citigroup. So, Citicorp is essentially a segment within the larger parent company.

Is Morgan Stanley owned by Citibank?

Morgan Stanley isn’t owned by Citibank; it’s a separate, publicly traded financial services firm.

Is Citigroup a good stock to buy?

Whether Citigroup is a good stock to buy depends on various factors such as market conditions, the company’s performance, and your personal financial goals. It’s best to consult a financial advisor.

What is Citi financial called now?

CitiFinancial has been rebranded as OneMain Financial.

What is the Chinese name for Citigroup?

The Chinese name for Citigroup is 花旗集团 (Huāqí Jítuán).

Is Citi Card part of Citigroup?

Yes, Citi Card is a part of Citigroup. It offers various types of credit cards to consumers and businesses.

Why is Citigroup so cheap?

Citigroup might seem cheap because its stock price can be influenced by a range of factors, including market conditions, investor perception, and recent performance metrics.