“`markdown

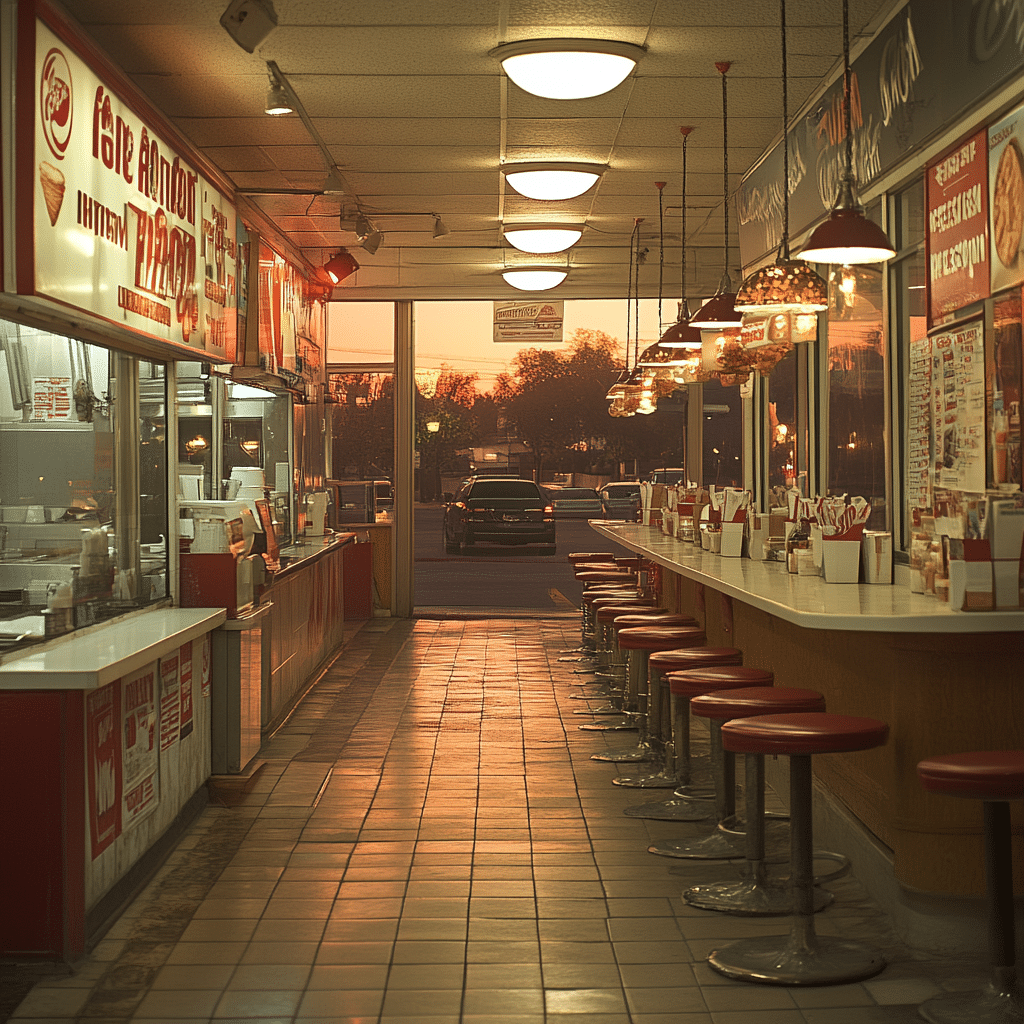

The Rise and Fall: A Historical Insight into Fast Food Chains

The fast food industry has seen explosive growth since its inception, but recent trends point to a dramatic shift. Brands like Subway, with its rapid expansion strategy, and Quiznos, known for aggressive franchising, faced financial troubles when market dynamics changed. Throughout its history, the fast food industry has been a roller coaster of triumphs and failures, and 2024 introduced a new twist: a major fast food operator chapter 11 filing.

In a shocking turn, Burger King, a titan in the fast food world, filed for Chapter 11 bankruptcy. This move heralds a critical juncture for the entire industry. The fallout from this decision is set to reshape not only Burger King’s future but also the fast food sector at large.

Factors Leading to the Chapter 11 Filing of Burger King

Competitive Pressures and Market Saturation

Competition in the fast food sector is fiercer than ever. Giants like McDonald’s, Wendy’s, and Taco Bell constantly innovate, investing in new technologies and offering healthier menu options. This relentless competition has flooded the market, leaving little room for error. Burger King’s struggle to differentiate itself played a significant role in its decline. The Chapter 11 of a prominent fast food operator like Burger King underscores the brutal competition in the industry.

Inflation and Rising Costs

In 2024, inflation soared to unprecedented levels, impacting pricing strategies across the board. The costs of ingredients, labor, and transportation skyrocketed, disproportionately hitting chains like Burger King, which rely heavily on volume sales to stay profitable. While rivals adapted through cost-cutting and local sourcing, Burger King found itself lagging. These financial pressures were key factors leading to the fast food operator chapter 11 filing.

| Category | Information |

| Bankruptcy Code | Chapter 11 |

| Purpose | Reorganization of business to keep it alive and pay creditors over time |

| Typical Outcome | Business proposes a reorganization plan |

| Business continues to operate | |

| Payments made to creditors over time | |

| Company Case Example | Rubio’s Restaurants |

| Bankruptcy Filing Date | June 2024 |

| Number of Locations | 86 |

| Geographical Spread | California, Nevada, Arizona |

| Famous For | Fish Tacos |

| Impact on Employees | Many employees may remain at work |

| Some employees may be laid off | |

| Laid-off employees owed wages and benefits become creditors | |

| Stock Trading | Stock might continue trading |

| Potential delisting from Nasdaq or NYSE | |

| Potential trading on Pink Sheets or OTCBB |

Impact of the Chapter 11 on the Fast Food Industry

Shuffling Market Shares

Burger King’s Chapter 11 filing has created ripples across the fast food industry. Competitors are now maneuvering to capture the market share left in uncertainty. Wendy’s and Chick-fil-A, known for strong customer loyalty and innovative menus, stand to benefit the most. Analysts suggest these brands could see a 10-15% increase in market share over the next fiscal year.

Supply Chain Reconfigurations

With Burger King’s bankruptcy, suppliers are reassessing their client portfolios. Smaller chains like Carl’s Jr. and Hardee’s may seize this opportunity to negotiate better terms, thereby fortifying their supply chains. This could improve their competitive positioning in a transforming market.

Strategic Responses by Competitors

Investments in Technology

McDonald’s, the industry leader, has doubled down on AI investments to enhance customer experiences. Their self-order kiosks and drive-thru innovations set new standards for the industry. The Chapter 11 filing of a major competitor like Burger King has only incentivized McDonald’s to further its tech-forward strategy, making it a tougher competitor.

Menu Innovations and Healthier Options

The push for healthier eating hasn’t slowed. Brands like Panera and Chipotle, which focus on fresh and nutritious food, continue to attract health-conscious consumers. Following Burger King’s downfall, even traditional fast food companies are revisiting their menus. They’re exploring plant-based options and integrating more locally sourced ingredients to adapt to changing consumer preferences.

Financial Implications and Investor Reactions

Stock Market Fluctuations

Burger King’s Chapter 11 filing triggered immediate reactions on the stock market. McDonald’s shares spiked by 3% on the news, while Yum! Brands, parent company of Taco Bell and KFC, saw a 2.5% uptick. Investor confidence in Burger King, however, nosedived, highlighting the volatile nature of the fast food sector.

Long-term Financial Health of the Industry

Industry experts believe that the Chapter 11 filing might lead to a more financially stable sector. Weaker players will be eliminated, paving the way for stronger, more adaptable firms to thrive. This could boost investor confidence and support a sustainable growth trajectory in the industry.

The Future of Fast Food: Trends to Watch

Sustainability and Ethical Consumerism

Consumer preferences are shifting towards brands with solid sustainability practices. Fast food operators that excel in transparency, ethical sourcing, and waste reduction will likely dominate the next decade. Brands like Shake Shack and In-N-Out, emphasizing quality over quantity, are setting new benchmarks.

Customization and Digital Experience

Customization is now an expectation, not a luxury. Consumers crave personalized dining experiences, whether through app-based ordering systems or customizable menu options. The fast food operator chapter 11 event highlights how crucial adaptability and customer-centric models are for future success.

Navigating the New Fast Food Landscape

In the wake of Burger King’s Chapter 11 bankruptcy, the fast food industry stands at a turning point. This event emphasizes the importance of agility, innovation, and responsiveness to changing market dynamics. As the fast food landscape undergoes significant transformation, operators who can deftly handle these turbulent waters will emerge stronger and more resilient in the years to come.

For additional perspectives on significant changes in the fast food industry, consider the viewpoints shared by industry insiders like Paul Chryst and academics such as Lehigh Gmail. Also, insights from local hero Demitri Allison offer a unique lens on navigating economic fluctuations.

By delving deep into the historical, economic, and competitive factors that culminated in Burger King’s Chapter 11 filing, this piece offers a comprehensive look at the fast food industry’s current state. As the sector faces its next big transformation, staying informed and agile will be the key to success.

“`

Fast Food Operator Chapter 11 Shakes Up Market

Corporate Struggles and Trivia Tidbits

Fast food operator chapter 11 filings often come with a mix of drama and curiosity. Ever wondered How much Does a notary make during these proceedings? Well, while the salary might not be sky-high, their role is crucial in keeping the paperwork in order. This raises eyebrows, doesn’t it? Shifting gears, not all companies tumble into chapter 11 due to sheer luck – it often involves a series of tactical mistakes.

Celebrities aren’t untouched by financial ups and downs either. Just ask Kristen Bell, who named her daughter Delta Bell shepard, a name some say was inspired by turbulent times. Talk about dramatic! Similarly, the unpredictable nature of the fast food sector mirrors these twists and turns. Businesses need to adapt quickly or face the fryer.

Pop Culture Connections

Speaking of adaptations, have you ever seen Oikawa, the charismatic character from Haikyuu? Fast food chains could take a page from his playbook, balancing resilience with creativity. This applies even when rebranding to stay afloat or diversify their menu offerings to keep up with trends. Adapting quickly is key – just like Oikawa does while juggling his team dynamics.

Random trivia to nibble on: Did you know the Fallfish, often overlooked, thrives in unlikely places, much like some fast food chains under chapter 11? Despite being underappreciated, they flourish with the right conditions. It’s a silver lining for companies whose stocks are seemingly in free-fall but manage to bounce back.

Pop Culture Masked Lessons

Intrigued by masks? Check out how the demon slayer mask from the anime series makes a statement. In tough markets, sometimes companies don masks of innovation and rebranding to stay relevant. Imagine if fast food joints embraced similar bold changes – surprising their customers with fresh, captivating identities.

Trivia and connections might seem random, but they shed light on the nuances of fast food operator chapter 11 and how these companies could navigate their way back to prosperity. Who knew pop culture and fish could provide insights into financial recoveries? It’s all about seeing the big picture.

What does Chapter 11 mean for a business?

Chapter 11 generally means a business is reorganizing its operations to stay afloat while paying its creditors over time. It’s typically used by corporations or partnerships to restructure their debt and plan for future profitability.

What fast food chain recently filed Chapter 11?

Rubio’s, a fast-casual restaurant chain famous for its fish tacos, recently filed for Chapter 11 bankruptcy protection in June. They had 86 locations across California, Nevada, and Arizona as of September 2024.

What happens to employees when a company files Chapter 11?

When a company files for Chapter 11, many employees may continue working and still receive their pay and benefits. However, there might be some layoffs, and those laid-off employees become creditors if they’re owed wages and benefits.

When a company files Chapter 11 what happens to the stock?

A company’s stock usually continues to trade after filing Chapter 11, but it often gets delisted from major exchanges like Nasdaq or NYSE if it doesn’t meet the listing standards. If delisted, it might trade on the Pink Sheets or OTCBB instead.

Do vendors get paid in Chapter 11?

Vendors may get paid during Chapter 11, but it often depends on the reorganization plan and the company’s ability to manage its debts. Vendors typically become creditors in the bankruptcy process.

What is the downside of Chapter 11?

The downside of Chapter 11 can include high legal fees, loss of control for management, and a damaged reputation. It’s a complex process that may not always lead to a successful reorganization.

Did Arby’s file chapter 11?

Arby’s did not file for Chapter 11. As of now, there’s no recent information indicating such action by the company.

What happens at the end of Chapter 11?

At the end of Chapter 11, a company has either successfully reorganized, emerging from the process to continue operations, or it might convert to Chapter 7 to liquidate its assets if reorganization fails.

What is the oldest fast food chain still operating today?

White Castle is the oldest fast food chain still operating today. It was founded in 1921 and continues to serve its iconic sliders.

How often do companies survive Chapter 11?

The survival rate for companies going through Chapter 11 varies, and not all make it. While some successfully reorganize and prosper, others might eventually liquidate or cease operations.

Do employees get severance in Chapter 11?

Employees may or may not get severance pay during Chapter 11. It really depends on the company’s policies and the specifics of the reorganization plan approved by the court.

Can a company recover after Chapter 11?

A company can recover after Chapter 11 if it successfully implements its reorganization plan, restructures its debts, and manages to return to profitability.

Who gets paid first in Chapter 11?

In Chapter 11, secured creditors usually get paid first. This is because they have legal claims on specific assets of the company, which take precedence over unsecured claims.

What is the success rate of Chapter 11?

The success rate of Chapter 11 varies widely. While some companies successfully reorganize and emerge stronger, others may not survive the process or may need to liquidate.

Who owns a company after Chapter 11?

After Chapter 11, the company’s ownership might change if creditors or new investors take equity as part of the reorganization plan. However, existing management might also continue to control the company.

Does Chapter 11 wipe out all debt?

Chapter 11 does not necessarily wipe out all debt. The reorganization plan usually involves restructuring debt, which might include partial payments or extending payment terms, but not a complete elimination.

Do most companies survive Chapter 11?

Most companies do not survive Chapter 11. The process is complex, and many businesses either fail to emerge successfully or convert to Chapter 7 liquidation later.

Can a company come back from Chapter 11?

A company can indeed come back from Chapter 11 if it effectively reorganizes its debts, improves operations, and returns to profitability. Success stories do exist.

Who owns a company after Chapter 11?

Ownership after Chapter 11 can shift, especially if creditors or investors take stock in exchange for debt cancellations. However, it’s possible for the original owners to retain control depending on the restructuring deal.