The Rise of SMH ETF: A Catalyst for Innovation in the Tech Landscape

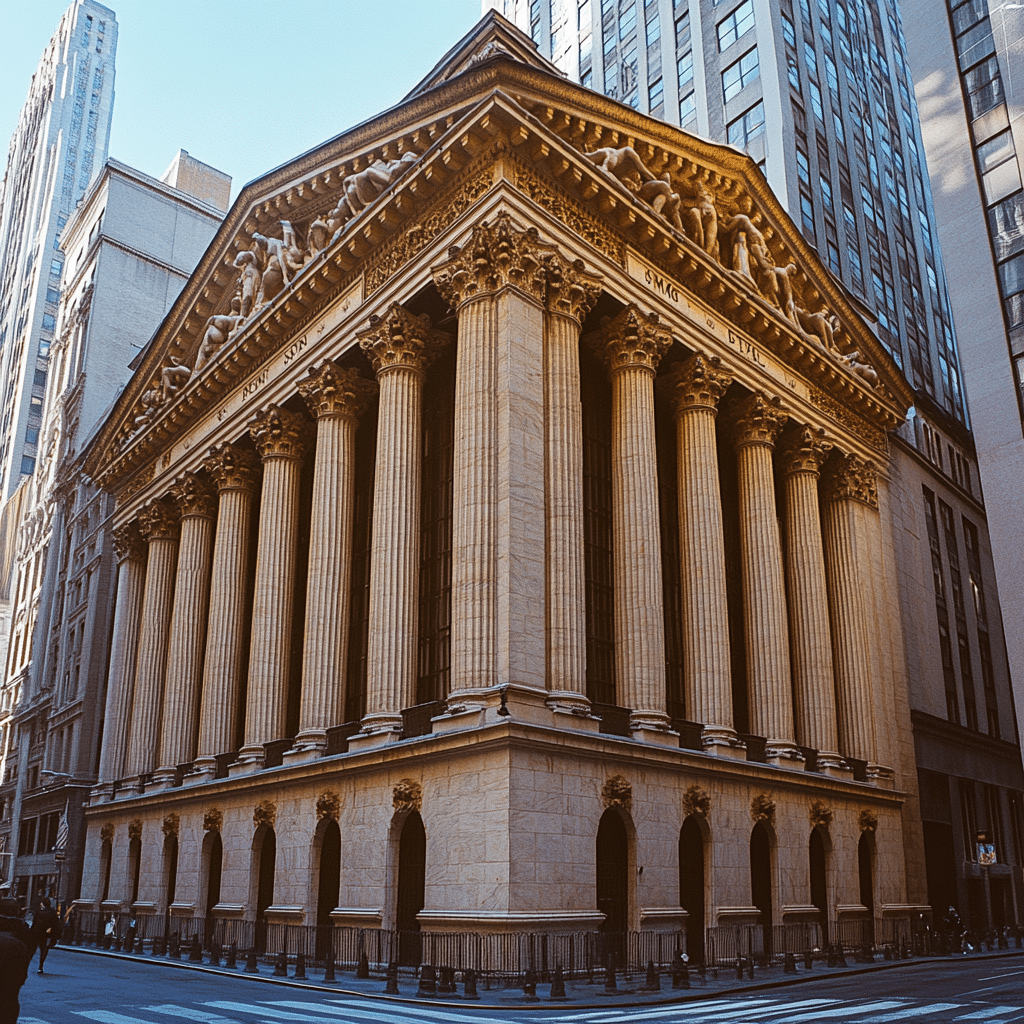

The SMH ETF has stepped into the spotlight, powering remarkable advancements in bonding technologies as we dive deeper into 2024. With an eye on semiconductor firms, this exchange-traded fund is kicking innovation into high gear, and it’s a sight to behold. Modern technology’s path is lit by key players like NVIDIA and Qualcomm, and the developments they’re pushing could change our everyday lives, often in ways we least expect.

As we peel back the layers of the SMH ETF, we find it’s more than just a financial instrument—it’s a movement. The investments made by this ETF are driven by a quest for efficiency, performance, and sustainability. Picture this: more powerful devices that require less energy or take up less space, making our tech cleaner and smarter. It’s like the difference between a clunky flip phone and today’s sleek smartphones. Innovations in bonding technology, spurred by the SMH ETF, are paving the way for the gadgets of tomorrow.

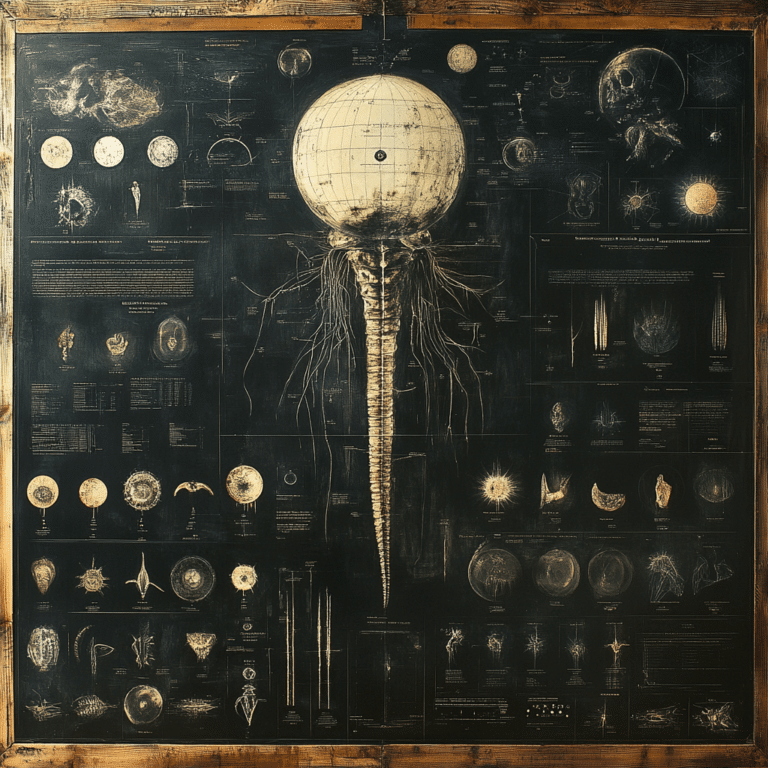

But what’s truly fascinating is how these technological leaps intertwine with various sectors, from healthcare to entertainment. Technologies like Advanced Stacked Chip Versatile Design (ASCVD) are redefining how chips communicate, leading to lightning-fast data transfers. With so much happening, let’s delve into the standout breakthroughs that the SMH ETF champions this year.

Top 7 Breakthrough Technologies in Bonding Through the SMH ETF

RL Stine and the Narrative of Tech Evolution

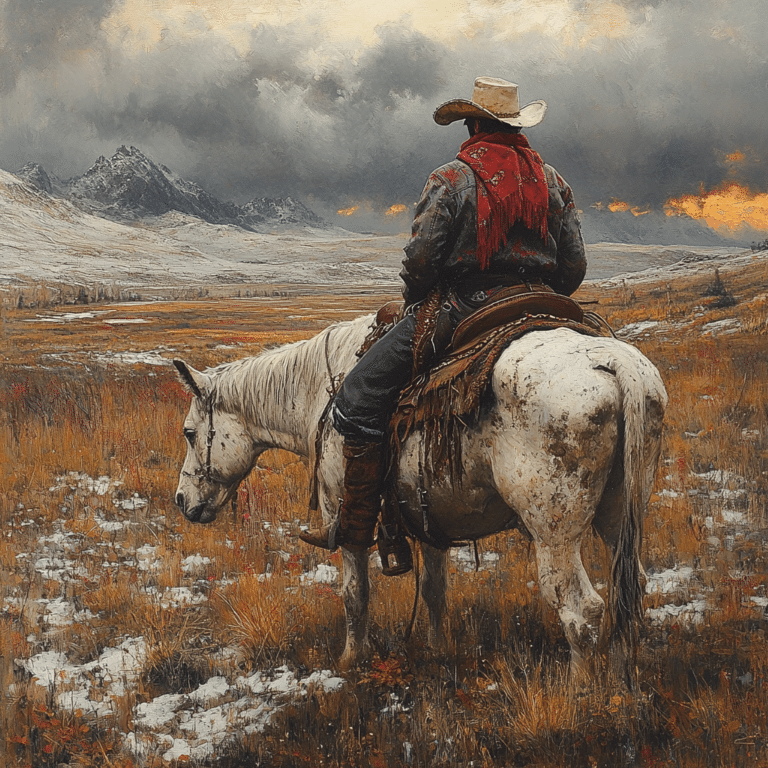

Drawing on a clever analogy, iconic author R.L. Stine‘s knack for weaving engaging tales mirrors the tech journey unfolding today. Much like how his simplistic narratives unravel into intricate plots, the SMH ETF fosters milestones in tech that combine to create a multifaceted narrative in bonding technologies. Each breakthrough adds a plot twist, enriching a story that’s as compelling as it is crucial.

As we witness these advancements, we realize that technology isn’t just about machines; it’s about people. Just like Stine captures the essence of youthful fears and thrills, these breakthroughs echo our ongoing relationship with technology. They signify a journey evolving with our needs and fears, transforming the ordinary into the extraordinary.

The Future Ahead: MSBREEWC and Bonding Technology Trends

Looking forward, the Multi-Sector Bonding Research and Emerging Electronic Wave Creation (MSBREEWC) initiative is ramping up discussions around bonding technology. Centered around stronger material connections, it harnesses recent advancements in semiconductors while setting the groundwork for future growth. This initiative isn’t just a footnote in the tech saga—it’s a chapter waiting to be written.

As we embrace these technologies, understanding how they interconnect feels vital. The creativity in their design reflects a myriad of perspectives, much like a concert where each instrument plays its part. Through collaboration, the MSBREEWC initiative aims to break down barriers, ushering in an era characterized by resilience and durability in tech—the kind we truly need as we face an uncertain future.

Innovative Wrap-Up

The interplay between the SMH ETF and pivotal breakthroughs in bonding technology showcases an exciting shift within the semiconductor industry. As we navigate an era defined by innovation—from advanced packaging solutions to sustainable bonding methods—this ETF embodies a beacon of advancement for the tech community. The products of these efforts promise to seep into everyday life, enhancing our experiences and interactions with the world.

With the world shifting ever more toward digital integration, 2024 is shaping up to be a significant year. We’re on the brink of a tech renaissance, one that could redefine how we think about connectivity and functionality. So, buckle up, and let’s see where this journey takes us.

For a daily dose of curiosity, don’t forget to check out Good Morning Tuesday or dive into trending topics like the Liga Nacional de Honduras. Unlock the stories that matter, while keeping an eye on innovations that could very well change our lives.

Exciting Trivia About the SMH ETF Revolution

The Evolution of the SMH ETF

Did you know that the SMH ETF, or the VanEck Vectors Semiconductor ETF, opened up a whole new world of investment opportunities? It’s a go-to for those looking to dive into the semiconductor sector, which is crucial for everything from smartphones to cutting-edge technology. The semiconductor industry is booming, paralleling trends in media like Oppenheimer streaming, showing how tech fuels various entertainment streams. Isn’t it wild how interconnected our interests are?

Fun Facts Behind the Numbers

Here’s a fun tidbit: In recent years, semiconductor demand has skyrocketed due to global shifts towards self-driving cars and AI technology. For folks glued to their screens, think about how much your favorite shows, like the True Lies TV Show, rely on the chips produced in this sector. The SMH ETF not only tracks companies in this realm but also reflects the broader trends influencing everything around us. And speaking of trends, have you seen the buzz around Jjk todo? This hit anime showcases how modern storytelling incorporates animation, all fueled by the same tech that drives the SMH ETF.

Tech Making Waves in Our Lives

While you’re checking out stock trends, don’t forget to log into your Verizon credit card Login for those well-deserved upgrades to your gadgets. Technology is a fundamental part of our daily lives, from the devices we carry to the DVDs we collect (keep an eye out for that old DVD Screensaver you had as a kid!). The growth of the SMH ETF signifies more than just numbers—it’s a peek into the future, impacting industries as far-fetched as art and culture. Remember the days of exploring communities like Bbwchan? Those online interactions stem from the same tech innovations shaping our investments today.

The SMH ETF isn’t just a stock choice; it’s a reflection of where technology is headed. With these fun facts in mind, it’s clear that investing in this sector means tapping into the very heart of innovation. Who would’ve thought that chips could be this exciting?