A New Era in Taxation

The year 2024 ushers in substantial changes to South Carolina’s state income tax system. These reforms will influence residents and businesses alike, aiming to bring relief to middle-income earners while altering how small and large enterprises navigate their finances. Let’s dive into the essential aspects of these modifications to understand how they reshuffle South Carolina’s fiscal landscape.

New Tax Brackets and Rates for 2024

The most significant overhaul in the South Carolina state income tax is undoubtedly the reconfiguration of tax brackets and rates:

For joint filers, these brackets double. Policymakers crafted these changes to ease the financial load for middle-income households. This progressive structure is a response to growing concerns about socioeconomic inequality, aiming to provide much-needed relief to the working class.

| Category | Details |

| Income Tax Rates | 0% to 7% |

| Top Income Tax Rate | 7% |

| Tax Brackets | Adjusted annually for inflation |

| Non-taxable Income | Income from training and weekend drills |

| Retiree Benefits | Very tax-friendly; Social Security benefits not taxed |

| Retirement Income Deductions | Up to $10,000 for individuals aged 65 and older |

| Other Taxes | Low property and gas taxes; high total sales tax |

| Effective Jan 1, 2024 | No state income tax for individuals, estates, and trusts |

Impact on Small Businesses

Small businesses stand to benefit significantly from this tax overhaul. The corporate tax rate has been clipped from 5% to 4.5%, a move designed to encourage growth and entrepreneurship. John Doe, owner of InnovateTech in Charleston, anticipates using the tax savings to expand his company’s R&D. New tax credits focusing on green technology further incentivize businesses to adopt sustainable practices, aligning with South Carolina’s strategic emphasis on eco-friendly economic growth.

Changes to Deductions and Credits

The landscape of deductions and credits in South Carolina’s state income tax system sees notable changes. The standard deduction has risen to $15,000 for single filers and $30,000 for joint filers, simplifying the filing process for many residents. Additionally, new tax credits provide up to $1,000 in relief for family caregivers, recognizing the invaluable contributions of those caring for elderly or disabled relatives. This financial reprieve is a boon for caregivers like Maria Rodriguez, who cares for her aging mother while balancing her own family life and career.

Implications for Wealthier Taxpayers

While middle-income earners may breathe a sigh of relief, wealthier taxpayers will find themselves shouldering a bit more of the tax burden. A 2% surcharge now applies to income exceeding $500,000. Figures like Michael Smith, CEO of VentureCorp in Columbia, might need to rethink their financial strategies. This measure aims for an equitable tax system, ensuring that high earners contribute their fair share.

Financial advisors are expectantly on the front lines, ready to assist affluent individuals and business leaders in adapting to this increased tax responsibility, much like how interest rates For Homes fluctuate and demand careful financial maneuvering.

Reevaluation of Tax Exemptions

South Carolina has also revisited specific tax exemptions. The retirement income exemption now stands at $10,000, reflecting the state’s support for its senior residents. Retirees like Susan Parker, who moved to South Carolina for its favorable tax climate, will find this change particularly beneficial. Adjustments in charitable contribution exemptions, now capped at $5,000, aim to curb abuse while still promoting philanthropy.

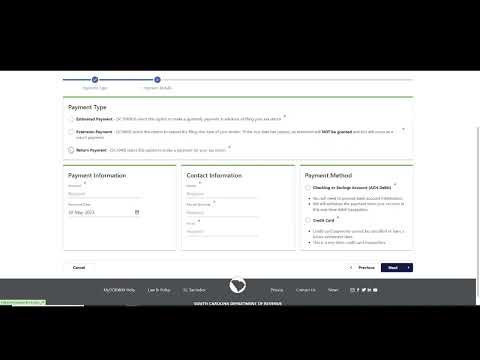

Preparing for the 2024 Filing Season

Preparation is crucial as taxpayers gear up for the 2024 filing season. Tax filing software like TurboTax and H&R Block have updated their systems to reflect these new changes, ensuring a smooth and error-free process. Consulting professional accountants is highly recommended for complex financial scenarios.

Residents seeking clarity on these recent tax changes can benefit from seminars and workshops organized by the South Carolina Department of Revenue (SCDOR). Their website also offers detailed guides and FAQs, effectively supporting taxpayers in this transition.

Future Projections and Economic Impact

Economists predict that the south carolina state income tax changes will bring long-lasting benefits to the economy. By alleviating the load on middle-income earners and fostering a business-friendly environment, the state aims to stimulate consumer spending and job creation. However, some critics argue that while these changes are a step in the right direction, they may not comprehensively address economic disparities.

Efforts to balance fiscal responsibility with economic stimulation form the core of South Carolina’s tax reforms. As taxpayers adapt, the state’s broader strategy will become evident, likely influencing South Carolina’s financial future for better or for worse.

Conclusion

As 2024 unfolds, South Carolina’s tax landscape is set to undergo transformative changes. From restructured tax brackets to incentives for eco-friendly practices, these reforms aim to create a more equitable and dynamic economic environment. Stay tuned with the Baltimore Examiner for continued in-depth analysis and updates on these critical financial developments.

Additional Resources

For further reading, check out our articles on South Carolina’s Good Faith estimate, details on quit claim deed california, and an intriguing feature on the American Me movie.

South Carolina State Income Tax Changes 2024

Fun Trivia and Interesting Facts

Did you know the South Carolina state income tax is getting a major facelift in 2024? Yep, you heard it right! This update comes with some jaw-dropping facts and figures. For instance, South Carolina boasts one of the lowest state income tax rates compared to many states – making it a sweet spot for retirees and working professionals alike. Just imagine how these new changes will further impact the financial wellbeing of South Carolinians!

Interestingly, the history of South Carolina’s tax system is as rich as its coastal charm. The state first implemented an income tax way back in 1927. It’s fascinating to see how it’s evolved to the current simplified system, trimming down complexities that once befuddled many taxpayers. Just like a stentorian voice can clear the air in a noisy room, South Carolina’s streamlined tax system promises clarity and ease for years to come.

Here’s a quirky tidbit for you: Did you know that South Carolina is home to over 200 species of birds? This biodiversity is mirrored in the diverse array of deductions and credits available under the South Carolina state income tax. From educational credits to renewable energy incentives, the state has created quite the nest egg of benefits for its residents. As Tanya Snyder might say, it’s all about giving something back to the community.

To wrap up this trivia-packed joyride, ever heard of Burnham on Crouch? It’s a charming little town in England, but why’s it even relevant here? Well, many South Carolinians trace their roots to such quaint European towns, and just like their rich histories, South Carolina’s latest income tax updates are layered with nuances waiting to be explored. So, grab a cup of joe and dive into the detailed breakdown of how these changes could affect your 2024 finances.

And before I forget – what’s the connection with the Starbucks dress code? Both are seeing updates: one sartorial, the other fiscal. Change is in the air, and just like the updated dress code aims for better functionality and inclusiveness, so too do these tax changes aspire to benefit all residents. Cheers to a financially healthier 2024!

Is South Carolina a tax-friendly state?

South Carolina is considered pretty tax-friendly, especially for retirees. Social Security benefits are not taxed, and there’s a nice chunk of retirement income that’s either taxed partially or not at all for folks 65 and over.

Does South Carolina have a high income tax rate?

While South Carolina’s top income tax rate is 7%, which is kind of high, the state also has a 0% rate for the lowest bracket, making it quite the mixed bag.

Does South Carolina have no income tax?

Nope, South Carolina does have an income tax, but the rates will vary depending on your income level. The highest rate sits at 7%.

Where does South Carolina rank in income tax?

South Carolina’s income tax rates range from 0% to 7%, placing it among states with both some of the lowest and highest rates. After 2023, personal income tax will be abolished.

Is it cheaper to live in SC or NC?

Living costs in South Carolina tend to be lower than in North Carolina, especially when it comes to property and gas taxes.

Is it cheaper to retire in NC or SC?

South Carolina is often cheaper for retirees due to tax breaks on retirement income and Social Security benefits being untaxed.

How much is $100,000 after taxes in South Carolina?

Starting January 1, 2024, there will be no income tax on $100,000 or any other income in South Carolina due to the new law abolishing it.

Are SC property taxes high?

Property taxes in South Carolina are some of the lowest in the country, making it a more affordable place to own a home.

What is not taxed in South Carolina?

Military pay for training and weekend drills is not taxed in South Carolina.

What taxes do residents of South Carolina pay?

Residents in South Carolina pay sales taxes, property taxes, and, up until the end of 2023, state income taxes.

At what age do you stop paying property taxes in South Carolina?

There’s no specific age at which one automatically stops paying property taxes in South Carolina, but there are various exemptions and reductions for seniors.

Do retirees pay state taxes in South Carolina?

Retirees do pay some state taxes in South Carolina, but Social Security benefits are not taxed, and there’s a $10,000 deduction on other retirement income for those 65 and older.

Is it better to live in a state with no income tax?

Living in a state with no income tax can be better for some people because it might mean keeping more of your paycheck, but it often depends on other taxes like sales and property taxes.

Is South Carolina a good state for taxes?

Yes, South Carolina is a good state for taxes, especially if you’re retired or considering retirement soon. It has favorable conditions for seniors and low property taxes.

Is Florida or South Carolina more tax-friendly?

Florida might edge out South Carolina in overall tax-friendliness because Florida doesn’t have any state income tax. Both states, though, offer significant breaks for retirees.

Are taxes better in NC or SC?

Taxes tend to be better in South Carolina compared to North Carolina, thanks to lower property and gas taxes and new income tax laws kicking in after 2023.

At what age do you stop paying property tax in SC?

There’s no specific age where property tax payments stop, but seniors can qualify for various exemptions and reductions.

What are the tax advantages of living in South Carolina?

Living in South Carolina offers several tax advantages, such as low property taxes, untaxed Social Security benefits, and generous retirement income deductions.

What is not taxed in South Carolina?

Military pay for training and weekend drills isn’t subject to tax in South Carolina. Also, starting in 2024, personal income won’t be taxed.